Revolut REVIEW – Payment apps and digital banks are the future of spending, transferring money, and maintaining accounts in today’s fast-paced world. Many people and businesses have already transitioned, and more are turning into it every day, Revolut is one such platform. Revolut, a digital-only bank founded in 2015, has more than 20+ million customers worldwide and processes more than 150 million transactions every month. Here is all you need to know on Revolut and let’s take a deep dive on this Revolut review to see whether is this one of the best bank for international students.

What all notable features will be useful for students?

Opening a bank account is one of the very important things to be taken care once you have landed in UK. Signing up with Revolut is simple once you’ve decided it’s perfect for you. All you need to do is download the app and register – Unlike other bank account opening process, no proof of address is required, and there are no credit checks, which expedites the process and can be completed in minutes.

However, you will need to verify your identity by photographing yourself and a valid identification document. The software is straightforward, easy to use, and streamlined. Revolut allows you to:

- Use it as your UK Bank/Expense Account – You’ll be given a UK account number as well as a sort code. You can use Apple Pay and Google Pay to make contactless payments, set up recurring payments, and withdraw cash from ATMs.

- Make international payments – Send money international in 30 different currencies to the country you want at the interbank exchange rate (the same rate that banks give each other).

- Hold different currencies – You can hold a balance on the app in 30 currencies (Revolut is also coming to India in 2022 – Stay Tuned).

- Pay/split bills with your friends – The “Group/Split Bills” tool is one of Revolut’s popular features. It makes it easier for Revolut users to manage group expenses, such as dividing a pizza order bill with roommates or settling up spending on a group vacation.

- View your spending habits – Using analytics tool, you can see your spending, categorised by type of transaction, by merchant or by country. You will also get weekly insights on where you want and how much you have spent on each category.

Also Read – The Kanban of an Investor – Plan To Be Rich

- Set spending limits and freeze card – You can set monthly spending restrictions which is really a useful feature for students, enable additional protection, and have the option to freeze or unfreeze the card if you have lost it.

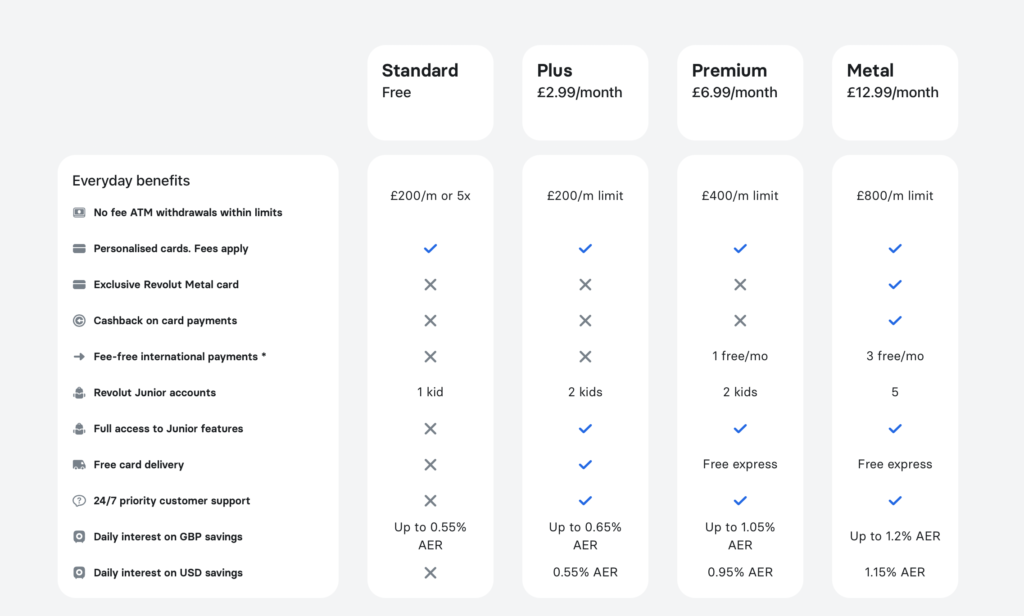

- Save money, Earn Interest– Here comes one of my favourite features in Revolut. Revolut operates a system of “Vaults”, which are essentially money-saving pots. You can open a standard Vault and top it up with regular payments or by automatically rounding up your spare change from your daily transactions to your Vault. You can also create a “Group Vault” with your friends to save for a common goal, such as a vacation. These are also interest-bearing vaults. As a result, the more you save, the higher your interest rate will be starting from 0.65% and goes up depends on the type of account you hold. Personally, I would recommend everyone to go for it as you will never know the money going out from your account to your vault and this will help you when you are broke.

- Cashbacks on every purchase – Get some of your money back on using in traveling and restaurants and also unlock new offers upon using Revolut cards. The cashbacks amount may vary depends on the type of account you hold which I have explained it below.

- Refer your friends and earn money –This is also one of the features I love from Revolut. Unlike, other referral programs where you only get £5 to £10, Revolut pays you £50 and above for each referral. I’ve explained it in detail. Keep reading!!

- Virtual Debit cards – Virtual cards work just like physical cards, only they are completely digital – or “virtual.” Because there is no physical card involved, virtual cards are best used for online payments or for purchases in-app on a mobile phone.

- And Much More – Apart from these, you can buy and manage Stocks, Cryptocurrencies, and gold etc. I’ve not mentioned these in detail as International students are not allowed to do these while pursuing their masters.

Getting started with Revolut

Types of Accounts

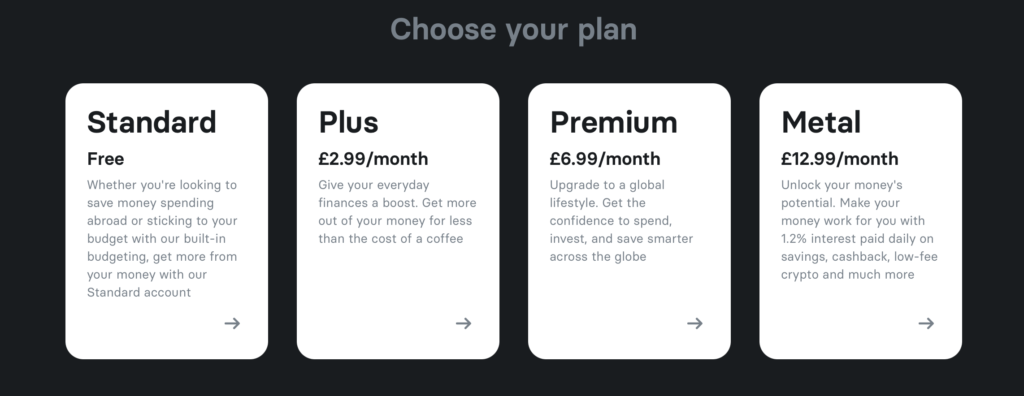

Revolut offers a range of accounts for personal users, in addition to their business account offerings. The below image explains the types of personal account plans you can opt when setting up your account. Here is a detailed breakdown.

Account set-up

- Opening a Revolut personal account is simple and straight-forward. It will take only minutes!!

- You need an UK mobile number or a mobile number from the country you are living now to start with the setup process.

- You just download the app or start setup your account from the LINK HERE or below.

- Once, you have entered your number, you will set a password and a 6 digit code will be sent to your phone to verify the account.

- It will ask you for your name, birth date, address, and email.

- Then you will make an initial deposit by putting in your bank details for a transfer to be initiated.

- Then you will need to provide a selfie and a picture of your passport for verification.

- The finally, You’ll be asked to select either a standard, premium, or metal account, and pay the fee (standard is free).

- Once this is all done, you will be asked an address to send your ATM via post. In the meantime, you can start using your account with your virtual debit cards.

- And now you are ready for shopping!!

Also Read – Inflation – Is it Good or Bad?

International money transfers

This is one of the very important reasons I personally use Revolut. We all know how poor and time-consuming the International money transfers are. services like Western Union and other bank transfers like SWIFT, etc. were the only way to move money abroad. But, Revolut and other digital banks are now trying to bring this down and it seems like working pretty good as well.

- Transfer Fees – Revolut’s money transfer fees are dependent on which package you are on, what kind of transfer you are making, when you’re transferring and how much you’ve transferred that month. If you have Revolut’s Premium or Metal package then that £1,000 cap is removed.

- Transfer limits – For most currencies, there are no transfer limits. However, with certain currencies, you may find that Revolut’s payment partners have set limits.

- Exchange rates – Revolut uses the “interbank” rate for currency exchanges from weekdays.

- Transfer Duration – Payments made to other Revolut users by card are instant. But a bank transfer to a non-Revolut bank account can take up to 5 days to reach your recipient.

- Countries – You can use Revolut’s money transfer service to send money to around 150 countries in Europe, the Americas, Africa and and Asia Pacific. Also, this is for our Indian readers, REVOLUT IS COMING TO INDIA. Yes, you read that right. The process has already started back in 2021 and it looks like it will be active by end of 2022.

Is Revolut safe?

You might think whether Revolut is safe since it has only the digital bank not a physical bank. The FCA regulates Revolut as an institution dealing in electronic money, and all client funds must be held in a “segregated account” at a licenced UK bank. This means that users’ money is kept separate from Revolut’s finances and cannot be invested by Revolut. So, even if Revolut as a company failed, your money couldn’t be used to pay off its debts.

In terms of account security, Revolut’s smartphone app is password or fingerprint ID protected. If your card has been misplaced, lost, or stolen, you can immediately freeze or unfreeze it in the app. Turning on or off online, ATM, and contactless payments provides additional control. Below are some more information for you.

Revolut Bank Support

Live Chat Support – 24/7 live chat available in app

Telephone Support – Call 020 3322 8352

Email Support – formalcomplaints@revolut.com

Touch Login – Yes, On the mobile app

Face ID Login – Yes, On the mobile app

Freeze card – Yes, on both app and online

Closing your account – Only via app

Report lost or stolen cards – Via app or call – 022 3322 8352

Cancel debit cards – Via app

POSTS YOU DON’T WANNA MISS!!

HOW CAN YOU EARN MONEY FROM REVOLUT

Yes, it is true. You can earn money from Revolut through their referral program. Here is how it works.

| How can you invite your friends? 1. Once you have joined Revolut successfully, open your app and tap the referral tile on the home screen or on your profile. 2. Select the friends you want to refer from your contact list. You can refer up to 5 friends. They just need to be eligible for a Revolut account and can’t already be a Revolut customer. 3. You can also share the code or the link with them on WhatsApp or a private message. |

| What do they need to do? 1. Create a Revolut account using your unique referral link. 2. Verify their identity and pass our Know Your Customer (KYC) checks 3. Top up their account by connecting another bank account or using a bank card 4. Order a physical Revolut card (delivery fees may apply) 5. Complete 3 purchases of at least £5 each with their Revolut card. Exclusions on transactions apply, please review full terms and conditions for more details. (Note: purchases can also be done with a virtual card while they wait for their physical one) 6. All the above needs to be completed before the deadline assigned to them once they sign in. You can also track these steps on your app and remind them to finish this process. |

| What’s in it for you and them? 1. Revolut reward you with £50 or even more for each friend that meets the criteria above, up to 5 sign-ups. Get the full terms and conditions on their blog. 2. Once they are done, they can start referring their friends and start earning. |

What are you waiting for then? Ready to bag easy money?

Our verdict

So far, I am very impressed with Revolut and would not hesitate to recommend to anyone who is looking for a bank account with no fees and the ability to use multiple currencies. Especially, if you are an international student moving to UK, Europe, US, Singapore or Japan, then Revolut got you covered!! All you need is your Passport and a mobile number from the country you live to get started.

There are also some other banks available similar to Revolut in UK and we’ll be reviewing and comparing – Revolut vs Monzo, Revolut vs Starling, etc.. Subscribe JUST A LIBRARY to get updates on those articles.

Stay tuned!! Stay Updated!!